Autonomy concerns in Telangana’s three-tier Cooperative structure

HYDERABAD, FEBRUARY 17, 2026: The Telangana State Cooperative Apex Bank (TGSCAB) is causing more loss to the cooperative sector with unnecessary interference in the functioning of the District Cooperative Central Bank (DCCBs), violating the norms ofthe Vaidyanathan Committee recommendations.

The Vaidyanathan Committee (Task Force on Revival of Rural Cooperative Credit Institutions) recommended strengthening the District Central Cooperative Banks (DCCBs) by promoting functional and operational autonomy, reducing state interference, and enhancing professional management.

The committee sought to make cooperatives member-driven institutions by amending cooperative laws to reduce state control over management and recruitment. The revival package recommended hiring professional staff, implementing training, and strengthening management, which implicitly requires autonomy in HR practices. States were encouraged to adopt model legislation ensuring autonomy, allowing DCCBs to operate as independent, competitive financial entities rather than government-controlled entities.

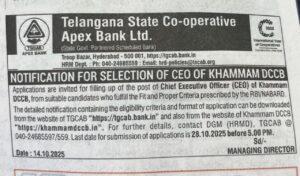

But the TGSCAB is causing more loss to the DCCBs by its unnecessary interference in the functioning of the DCCBs. The TGSCAB has issued a notification for the recruitment of DCCB CEOs in Adilabad, Mahaboobnagar and Khammam districts in the month of October 2025 from suitable candidates who fulfil the Fit and Proper Criteria prescribed by RBI and NABARD. Ironically, the TGSCAB had recruited its own AGMs as CEOs, violating the norms stipulated by the Vaidyanatham Committee.

The Cooperative Credit System in Telangana operates under a structured three-tier framework designed to ensure decentralisation, democratic governance, and institutional independence.

At the apex level functions the State Cooperative Apex Bank, whose members and shareholders are the District Cooperative Central Banks (DCCBs). At the second tier, the District Cooperative Central Banks function as independent financial institutions, with Primary Agricultural Cooperative Societies (PACS) as their members. At the grassroots level, PACS directly serve farmers and rural communities.

This structural arrangement reflects a clear hierarchy of membership and accountability. However, what makes the situation noteworthy is that all three tiers are legally recognized as autonomous institutions, each governed by its own statutory powers and responsibilities.

Emerging Issue

Despite the autonomy granted to each tier under the Cooperative Societies Act, concerns have been raised regarding the increasing involvement of the State Cooperative Apex Bank in the functioning of lower-tier institutions.

Reports indicate that such involvement extends to matters including recruitment of employees in District Cooperative Central Banks, recruitment processes in Primary Agricultural Cooperative Societies, appointment of Chief Executive Officers of District Central Banks, and various administrative and operational decisions.

The question that arises is whether such extensive intervention aligns with the principle of institutional autonomy that forms the backbone of the cooperative movement.

Implications for Institutional Independence

Cooperative institutions are founded on the principles of democratic control, self-governance, and member participation. Each tier, though structurally interconnected, is expected to function independently within the framework of the law.

When higher-tier institutions involve themselves in recruitment, appointments, and administrative matters of legally autonomous bodies, it may give rise to concerns regarding erosion of self-governance, dilution of accountability, centralization of authority, and departure from cooperative principles.

The Reform Context

The recommendations of the Vaidyanathan Committee, implemented across India to strengthen cooperative credit institutions, emphasized financial restructuring, professional management, democratic functioning, and protection from undue interference.

The reform package, accompanied by agreements between State Governments and the Government of India, underscored the importance of safeguarding the autonomy of cooperative institutions.

Furthermore, the State Cooperative Societies Act provides for defined roles and responsibilities at each tier. Respecting these statutory boundaries is essential for maintaining institutional credibility.

The Need for Course Correction

In light of these concerns, it is imperative that the spirit and letter of the Vaidyanathan Committee recommendations be upheld, reform agreements entered into by the State be honoured, the State Cooperative Societies Act be implemented in its true intent, and each tier be allowed to function within its legally defined jurisdiction.

Failure to maintain this balance may lead to growing uncertainty about the independence and sustainability of the cooperative credit system in Telangana.

The cooperative movement is not merely an administrative structure—it is a democratic financial institution rooted in trust, participation, and decentralization. Preserving its autonomy is essential to ensure its continued service to farmers and rural communities.